This article will examine the influence of India’s economic growth on the luxury market, investigating the changing dynamics between the emerging economy and luxury consumption. Additionally, it will outline the key segments of Indian luxury consumers, both current and anticipated in the future.

Luxury markets in developing vs developed countries

The special aspect of a developing nation lies in its ability to allow people to move between different social classes while still contributing to the overall economy. For instance, in India, the number of millionaires is expected to double from 750,000 to 1,600,000 by 2027.

In contrast, the mobility between social and economical class in developed nations is notably constrained due to the inherent stability of their Gross domestic product. Conversely, within emerging economies like India, characterized by rapid economic expansion, opportunities for wealth accumulation proliferate. Here, individuals engage in a competitive pursuit aimed at augmenting their social standing through increased earnings and conspicuous displays of success.

Five stages of luxury consumption

Countries go through five stages of the luxury consumption cycle proposed by (Ashok Som and Christian Blanckaert, 2015) in their book, these stages are important to understand to better understand the dynamics of the Indian market within the contemporary landscape of burgeoning economic development:

- Deprivation Phase: In this stage, a country burdened by poverty generates a longing for luxury consumption.

- Progress Phase: The second stage witnesses economic progress, enticing citizens with functional luxuries such as washing machines and cars.

- Wealth Showcase Phase: The third stage is marked by a desire to showcase wealth, turning luxury into a symbol of social status.

- Social Conformity Phase: As resources become more abundant in the fourth stage, individuals feel compelled to conform to social norms, using luxury as social markers for group acceptance.

- Lifestyle Integration Phase: In the final stage, people embrace luxury as a lifestyle, having become accustomed to its presence.

India are experiencing an economic boom and the changing landscape is creating a new base of potential luxury customers of all segments and all levels.

Indian luxury consumer segments

According to our survey done with participants from all parts of India, we have identified five principal segments profiles with their distinct behavior, characteristics, and needs.

Not yet rich

This segment predominantly comprises participants with a net worth below 1 crore(110 000 €). They are employed in private companies and have rarely traveled outside of India.

They perceive luxury as a ‘Sign of beauty‘, followed by a ‘Particular lifestyle‘.

They are budget-conscious but aspire to the luxury lifestyle. They may prioritize experiences over products and seek accessible luxury options. Their favorite luxury category could be travel, fashion, followed by watches.

This segment is not yet ready for luxury consumption but may transition to a higher net worth category in the coming years with the development of the Indian economy.

Old rich

This segment comprises families with inherited wealth, often referred to as “old money” They prioritize heritage, craftsmanship, and understated luxury.

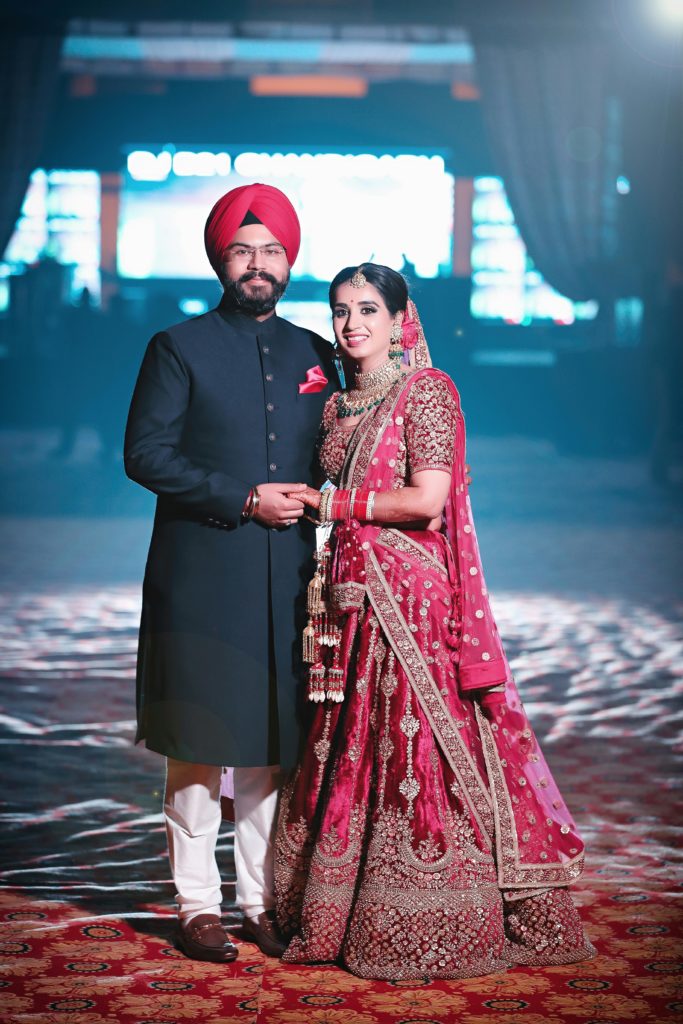

Brands with a rich history and impeccable quality resonate with them. They declare to wear traditional attire during traditional celebrations.

The profiles of this segment are mainly involved in family business. Their net worth mainly ranges between 1 crore(110 000 €) to 30 crores( 3 300 700 €). Their travel frequency ranges from 1 to 5 trips over the past two years.

They associate luxury with products made in Europe but are open to buying Indian-made luxury items.

New rich

The “new money” segment is composed of self-made individuals who have achieved financial success.

They are brand conscious and appreciate the status symbol associated with luxury. They seek recognition and tend to favor logos and bold design statements.

This segment is predominantly composed of individuals engaged in entrepreneurship, with the majority falling within the net worth range of 1 crore(110 000 €) to 5 crores(550 700 €), followed by those with a net worth ranging from 5 crores(550 700 €) to 10 crores(1 100 500 €).

Their preferred luxury category is luxury travel, although they also exhibit interest in luxury bags, watches, and fashion.

Typically, their travel frequency ranges from 1 to 5 trips over the past two years. Moreover, they perceive luxury purchases primarily as a “symbol of personal success,” followed by as a “guarantee of social standing“.

Indian diaspora

Global citizens with Indian roots Non-Resident Indians (NRIs) who return to India often have a global perspective on luxury. They value international brands but are also drawn to homegrown labels that cater to their Indian sensibilities. The pursuit of knowledge has propelled individuals of Indian origin to prominent positions across diverse sectors, including academia, science, economics, and politics. Notable examples include Rishi Sunak, the Prime Minister of the United Kingdom; Satya Nadella, CEO of Microsoft; Sundar Pichai, CEO of Alphabet (formerly Google); Leena Nair, CEO of Chanel; Arvind Krishna, CEO of IBM; Ajay Banga, President of the World Bank Group; and Lakshmi Mittal, CEO of ArcelorMittal.

The Indian travelers and the Indian diaspora represent great opportunities for the western luxury brands to establish connections with India.

Understanding these segments is crucial for luxury brands to tailor their marketing strategies and product offerings. By catering to the specific needs and desires of each segment, brands can establish a strong foothold in the ever-evolving Indian luxury market.

Bibliography

Som, Ashok, and Christian Blanckaert. The Road to Luxury: The New Frontiers in Luxury Brand Management. Second Edition. John Wiley & Sons, 2021.